Verification of Payee

Important information about the new SEPA verification

As of 9 October 2025, banks in the European Payment Area will be required to carry out a so-called Verification of Payee (VoP) before each authorization of a SEPA transfer and SEPA real-time transfer. This is a technical IBAN name comparison.

Current notice dated 08/09/2025:

In August 2025, the German Federal Financial Supervisory Authority (BaFin) published “Questions and answers on the regulation on real-time transfers” (BaFin – FAQs). In these FAQs, BaFin also comments on the topic of “bulks with only one transfer order.” After reviewing the FAQs, we would like to inform you of the following:

As of October 5, 2025, Hamburg Commercial Bank AG will not perform verification of payee if a customer who is not a consumer (e.g., a corporate customer) submits an opt-out EBICS collector with only one transfer order to the EBICS bank computer (TCU).

Verification of Payee – What is behind it?

The VoP is introduced to prevent fraud in the SEPA area. It makes it possible to check whether the recipient‘s name and IBAN match the data registered with the recipient‘s bank before making a payment. The ordering party‘s bank sends the VoP request to the

recipient bank before authorization. The bank checks whether the IBAN and recipient name match the stored account holder data and reports the result back to the ordering party of the payment.

Procedure for the opt-in check

1. Your payment will be sent to the bank with a transport signature

2. The bank carries out the IBAN name comparison.

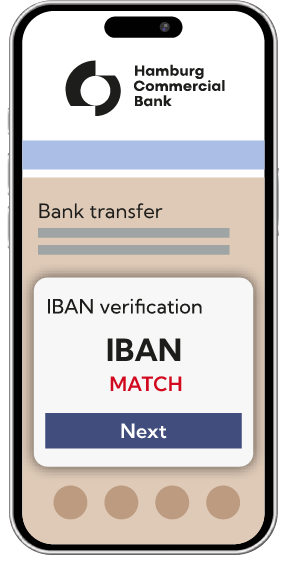

3. You will receive one of the following results within a few seconds:

Match: Name and IBAN match the data at the recipient bank.

Close match: The name sent partially matches the name stored at the recipient bank.

No match: There is no match with the recipient‘s name

No check: : Check not possible (e.g. due to timeout).

What happens next?

After the check, you will receive a log in the new pain.002 VoP format (Electronic Banking). You can then release or cancel the payment.

What does the introduction of VoP mean for your company?

Your company can decide whether to use the IBAN name reconciliation (opt-in) or decline its use (opt-out).

Opt-in: The bank assumes liability for the IBAN name comparison.

Opt-out: You remain fully liable for the accuracy of the recipient data.

The VoP check requires changes in EBICS communication. The following adjustments are expected:

- The inspection result is included in the signature folder (VEU folder).

New EBICS order types are introduced:

-

- CTV: for SEPA transfers

- CIV: for SEPA real-time transfers (Instant Payment)

- VPZ (VoP status report pain.002)

- We will provide you with the new order types automatically. You do not need to request them.

Please check whether your banking or treasury software (e.g. SAP) is compatible by 6 October 2025!

Please consider the following points when using the opt-in option:

Further processing: If you use treasury systems, check whether the new pain.002 VoP file can be processed.

Correct company name: Make sure that the debtors use their exact company name as stated in the account agreement. This will help to avoid delays in receiving payments.

Data reconciliation: Please clarify in advance how changes to client and recipient data can be synchronized between your master data system and the EBICS system.

- Weitere Informationen finden Sie unter www.ebics.de/de/ebics-standard/hinweise-hersteller-kunden