Shaping the future of property management

Getmomo Financial GmbH (Getmomo) offers a digital banking platform that is specifically tailored to the needs of the real estate industry. In cooperation with Hamburg Commercial Bank, the company supports numerous property management companies in Germany.

Innovative banking solutions for property management companies

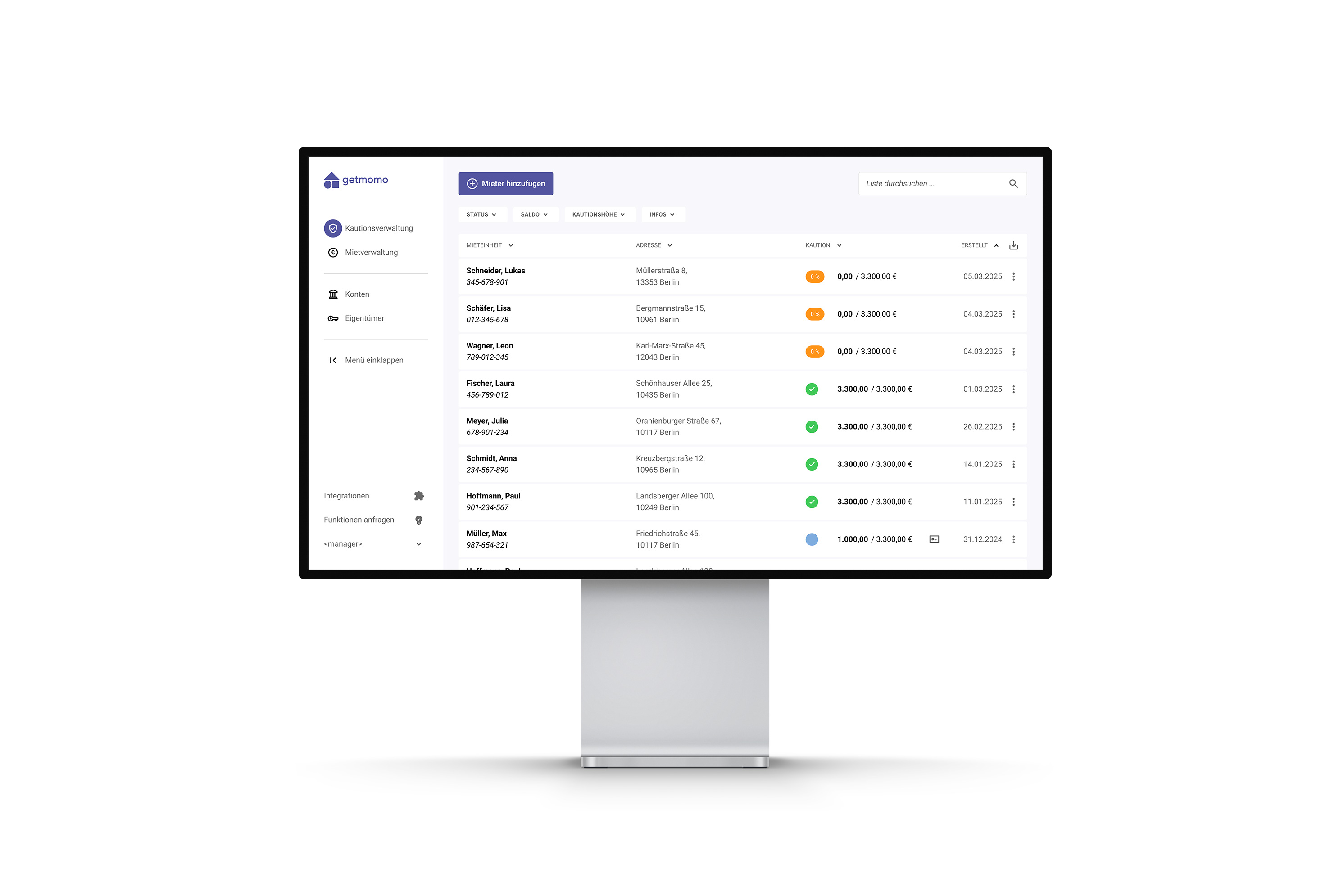

Getmomo develops solutions for the efficient management of residential properties. Through automated processes and digital processing, Getmomo significantly reduces administrative effort and supports property management companies in saving time and costs. Hundreds of property management companies and companies in the housing industry gain access to all the banking products they need via the Getmomo platform. The platform works as a plug-and-play solution that can be used without implementation effort and enables direct working time savings of up to 40%. The platform’s focus is on automating the entire payment process – independently of and fully complementary to the ERP solution already in use in the company.

Project details

Getmomo was looking for a commercial bank that had a high-performance product portfolio for the housing industry, offered modern interfaces for connection to the Getmomo platform, had an excellent credit rating and brought an entrepreneurial culture to the table.

The aim was to provide property management customers with rapid support in the digitalisation and automation of payment transaction tasks. From the outset, the collaboration with HCOB was characterised by a high degree of pragmatism and speed. Shortly after the start of the cooperation, numerous customers were able to significantly reduce their daily payment transaction workload via the Getmomo platform.

Housing industry: A turning point in payment transactions

Getmomo is consistently developing its services for the housing industry in line with customer needs. To do this, it needed a banking partner like HCOB – with a high-performance product portfolio as a basis for further services and the aspiration not to be satisfied with the status quo. In HCOB, Getmomo has found a partner on whom customers in the housing industry can rely.

At getmomo.de/en you will find further information on the services offered by Getmomo.

“Modern payment transaction systems and a willingness to go the extra mile to meet customer requirements have convinced us to further expand our cooperation with HCOB.”

Marcel Meitza, Geschäftsführer der GetMomo Financial GmbH

The future of payments

With the help of smart and streamlined solutions, payment flows can be managed much more effectively and efficiently today than in the past. This considerably reduces the burden on companies in terms of their own processes, saves time and money, and thus frees up resources for their core activities: working in the market and for customers. We are a leader in innovative, digital solutions for cash management.

Stefanie Buhtz

Team Head of Cash Management SalesJutta Arlt

Head of Cash and Trade ServicesTorsten Rösner

Sales Manager Cash Management Corporates & Project FinanceArrange a consultation appointment

To enable us to prepare for the appointment in the best possible way, we would ask you to briefly explain your concerns to us.

Technology and industry expertise

For us, technology is not an end in itself or the holy grail. Technology helps and supports us so that we can build up very specific expertise in our personal contact with our customers. And we always take the time to do this, because we like to know our business partners well and personally.

High-performance payment transactions are all about being able to execute transactions for tens of thousands of your customers simultaneously in various currencies, with fast processes in eBanking and modern subscription procedures via app.

We manage interest rate and currency risks for you using tailor-made products. We will work with you to find the optimum solution. This allows you to hedge risks, improve your company’s liquidity and strengthen your balance sheet.

Whether you are looking for a bridging loan, balance sheet relief, improvement of your asset position, company expansion or restructuring – we offer you the entire range of solutions.